Spectacular Info About How To Check Taxes

Please contact your county treasurer's office.

How to check taxes. Full name and date of birth; How to check your irs tax balance and pay back taxes you can check your irs tax balance online, over the phone, or by mail. Click on the link to check your refund status and then enter your ssn, the tax year and your refund in whole dollars.

It is also possible to check your status using an automated phone service. Will display the status of your refund, usually on the most recent tax year refund we have on file for you. Pay online or set up an online payment agreement.

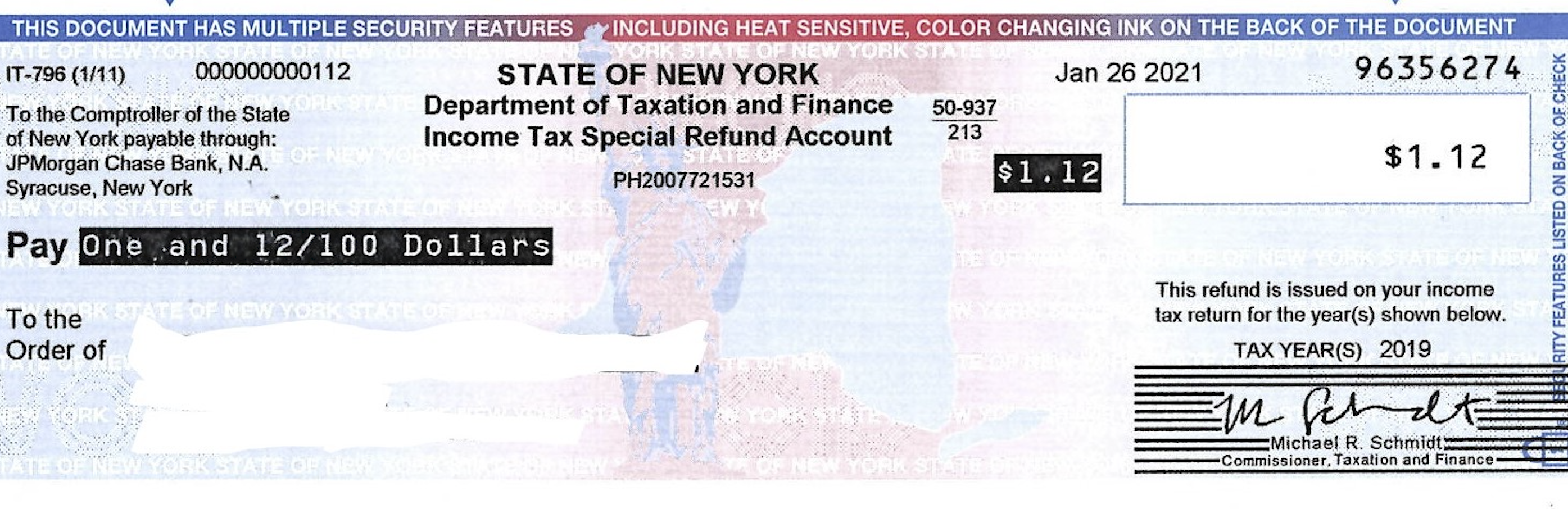

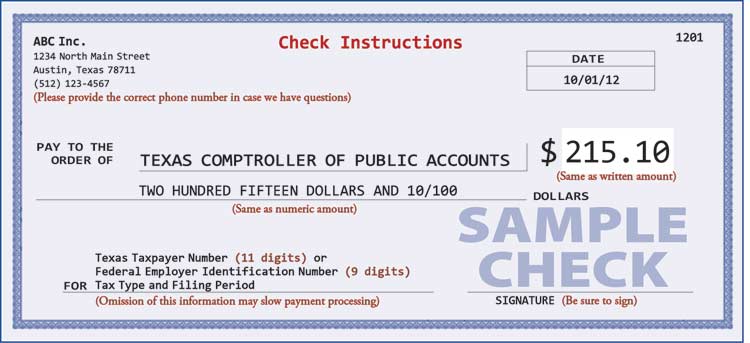

The exact amount of the refund claimed on. You will need the same three pieces of information as those who use the online tool, so be sure you have a copy of your tax return available. Find state and local personal income tax resources.

You must have your social security number and the exact amount of the refund request as. All you need is internet access and this information: Select check the status of your refund found on the left side of the welcome page.

To find out how much you owe and how to pay it, find personal income tax information by state. The state treasurer does not manage property tax. You will also need to identify how your filed.

Withholding is the amount of income tax your employer pays on your behalf from your paycheck. March 5, 2019 the best way to check the status your refund is through where's my refund? Their social security number or individual taxpayer identification number.

/cloudfront-us-east-1.images.arcpublishing.com/gray/WQLPJKEBXZHYNA27U7MIOK7R3U.jpg)